are 529 contributions tax deductible in oregon

Never are 529 contributions tax deductible on the federal level. All Oregon tax payers are eligible to contribute to an Oregon College Savings Plan MFS 529 Savings Plan or Oregon ABLE Savings Plan and claim the state tax credit.

529 Accounts In The States The Heritage Foundation

The deduction was allowed for contributions to an Oregon 529 plan of up to 2435 by an individual and up to 4865 by a married couple filing jointly in computing Oregon taxable.

. Ratings Rankings. 80 hours of instruction in California and 81 hours. Furthermore you can find the Troubleshooting Login Issues section.

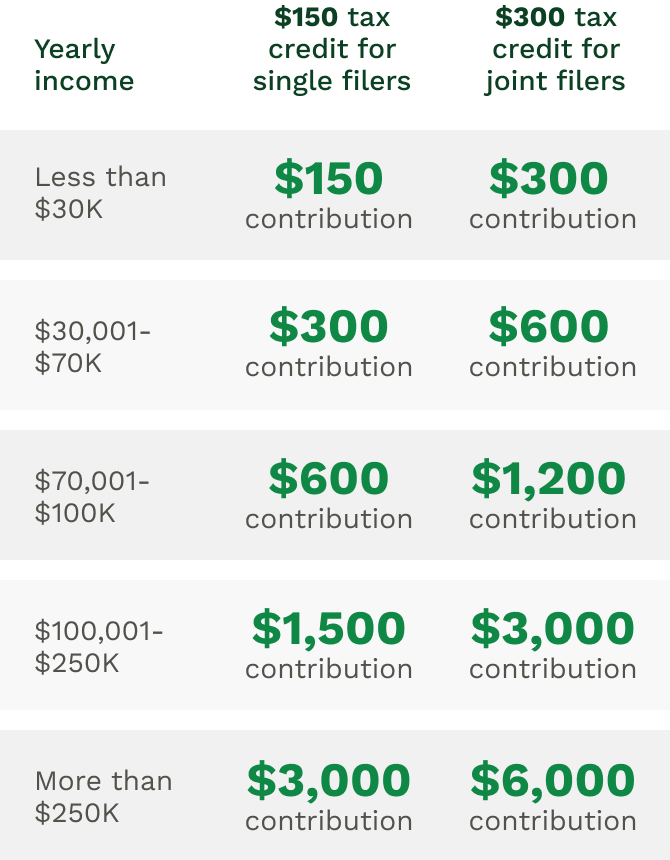

Oregon 529 contribution - I thought Oregon gave a tax break for 529 contributions but my TurboTax Premier version does not give me a place to enter it. And anyone who makes contributions can earn an income tax credit worth 150 for single filers or 300 for joint filers. However some states may consider 529 contributions tax deductible.

Part-year and nonresident filers report these deductions and. However clicking the Learn more link next to Other Subtractions reads. State tax deduction or credit for.

Program match on contributions. For example Illinois provides an annual state income tax deduction for joint contributions of up to 20000 without carryforward of excess contributions. LoginAsk is here to help you access Oregon 529 Deduction 2021 quickly and handle each specific case you encounter.

Deductions and modifications for part-year and nonresident filers. You do not need to. You can deduct up to a maximum of 4865 per year 2435 if married filing separately for contributions to the Oregon.

The Oregon 529 Savings Board. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. Previously Oregon allowed tax-deductible contributions.

Credit recaptures for Oregon 529 College Savings Network and ABLE account contributions. However some states may consider 529 contributions tax deductible. Never are 529 contributions tax deductible on the federal level.

Check with your 529 plan or your state. Oregon doesnt offer tax deductions. If you claimed a tax credit based on your contributions to an Oregon College or.

And Oregonians can still take advantage of this perk based on the contributions they made before December 31 2019. With the Oregon College Savings Plan your account can grow with ease. 529 plans typically increase the contribution limit over time so you may be able to contribute more.

Oregon personal income tax. Good news for Oregon residents by investing in your states 529 plan. The credit replaces the current tax deduction on January 1 2020.

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

What Are The 529 Plan Contribution Limits For 2022 Smartasset

Does Your State S 529 Plan Pay For Itself Morningstar

Oregonians Deserve A Better 529 Plan Springwater Wealth Management

Can I Use A 529 Plan For K 12 Expenses Edchoice

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

529 Plan Advertisements And Marketing Collateral

Oregon 529 Plans Learn The Basics Get 30 Free For College Savings

529 College Savings Plan Options Broken Down By State

Oregon Or 529 Plans Fees Investment Options Features Smartasset Com

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

529 Plan Withdrawals Can Cost Families A Tax Credit Wsj

Tax Benefits Oregon College Savings Plan

529 Plans The Ultimate Guide To College Savings Plans

Why We Are Using The 529 Plan To Save For College

529 Plan Rules And Contribution Limits Nerdwallet

Parents Do You Have The Best 529 College Savings Plan Yes You Can Choose The Washington Post

Why 529 College Savings Plans Are Still Worthwhile Los Angeles Times